Table of Contents

- Introduction

- Understanding High-Value Real Estate Investments

- Key Indicators of a Profitable Property

- How Location Determines Property Value

- Evaluating Market Trends and Growth Potential

- The Role of Infrastructure and Development Plans

- Assessing Legal and Regulatory Factors

- Financial Considerations and ROI Analysis

- Common Pitfalls to Avoid in Real Estate Investments

- Why Thigio in Kikuyu is a Prime Investment Location

- Conclusion

- Call to Action

- Additional Information

1. Introduction

Kenya’s real estate market is filled with lucrative opportunities, but knowing how to identify high-value investments is crucial for long-term success. Whether you’re a seasoned investor or a first-time buyer, making informed decisions can significantly impact your returns. In this guide, Dennkarm Prime Properties shares 5 powerful ways to identify top-tier real estate investments in Kenya, with a special focus on promising locations like Thigio in Kikuyu.

2. Understanding High-Value Real Estate Investments

A high-value property investment is one that offers excellent appreciation potential, strong rental yields, and long-term stability. Investors should consider:

- Market demand – Does the location attract buyers or tenants?

- Economic factors – Is the area poised for growth?

- Government initiatives – Are there policies favoring development in the region?

- Property usability – Does it cater to multiple investment needs (residential, commercial, mixed-use)?

3. Key Indicators of a Profitable Property

To ensure you’re making a high-value investment, watch for these critical indicators:

- Property Appreciation Rates – Areas with consistent price increases indicate strong demand.

- Rental Yield – Locations with high tenant demand ensure steady rental income.

- Infrastructure Growth – Roads, electricity, water, and security improvements boost property value.

- Proximity to Amenities – Schools, hospitals, and business centers enhance desirability.

4. How Location Determines Property Value

The golden rule of real estate is location. Consider the following when assessing a property’s potential:

- Proximity to Nairobi and other economic hubs – Areas like Thigio in Kikuyu are growing due to their strategic positioning.

- Future Development Projects – Government and private sector investments drive value appreciation.

- Neighborhood Growth Trends – Population influx often signals increasing property demand.

5. Evaluating Market Trends and Growth Potential

Staying ahead of real estate trends helps investors make smart decisions. Here’s what to consider:

- Historical Price Trends – Compare past price changes to predict future growth.

- Demand vs. Supply – High demand with low supply means stronger investment potential.

- Emerging Hotspots – Locations like Thigio in Kikuyu are gaining attention due to rapid development and affordability.

6. The Role of Infrastructure and Development Plans

Infrastructure is a key determinant of property value. Investments in roads, water, and electricity increase demand.

- Government Development Projects – Upcoming highways and railway stations enhance accessibility.

- Commercial Centers – Business hubs boost employment, attracting homebuyers and tenants.

- Education & Healthcare Facilities – Schools and hospitals make an area more livable and valuable.

7. Assessing Legal and Regulatory Factors

Avoiding legal pitfalls ensures a secure investment. Always verify:

- Land Ownership Documents – Confirm title deeds and land tenure systems.

- Zoning and Land Use Regulations – Ensure the property meets legal requirements.

- Government Approvals – Confirm compliance with municipal planning authorities.

- Reputable Sellers & Developers – Work with trusted real estate companies like Dennkarm Prime Properties.

8. Financial Considerations and ROI Analysis

Understanding financials helps investors maximize returns. Consider:

- Initial Cost vs. Long-Term Value – Compare upfront costs to expected appreciation.

- Rental Income Projections – Estimate monthly income against expenses.

- Flexible Payment Plans – Seek developers offering installment options.

- Tax Implications – Understand property taxes, stamp duty, and capital gains tax.

9. Common Pitfalls to Avoid in Real Estate Investments

Avoiding common mistakes can save investors from costly errors:

- Overlooking Due Diligence – Always verify ownership and approvals.

- Ignoring Market Trends – Stay updated on shifting demand and pricing.

- Underestimating Maintenance Costs – Factor in long-term expenses.

- Failing to Seek Expert Advice – Partner with professionals like Dennkarm Prime Properties for guidance.

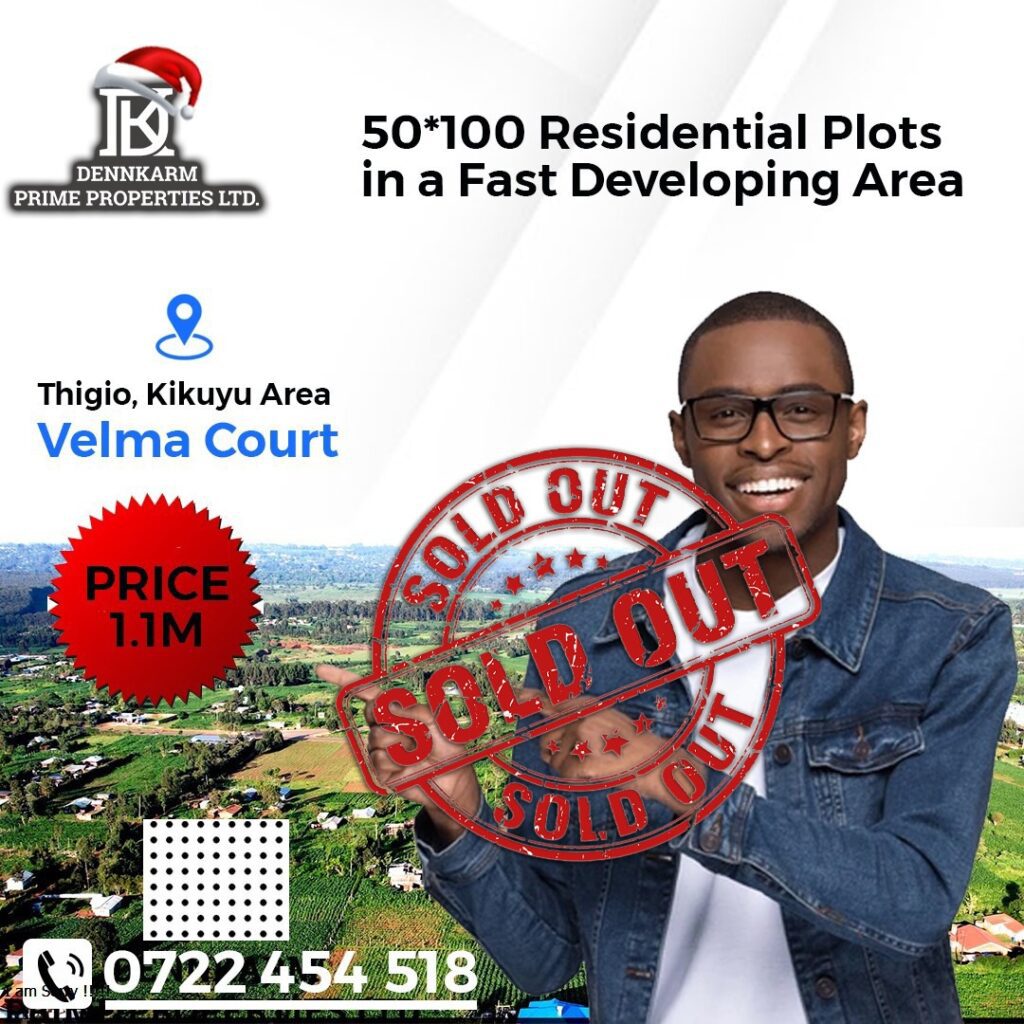

10. Why Thigio in Kikuyu is a Prime Investment Location

Thigio in Kikuyu is an emerging real estate hotspot due to:

- Proximity to Nairobi – A growing commuter town with high investment potential.

- Affordable Land Prices – Investors can secure prime property at competitive rates.

- Infrastructure Development – Improved roads and utilities are enhancing its appeal.

- High Demand for Residential & Commercial Spaces – A rising population is increasing housing needs.

11. Conclusion

Investing in Kenya’s real estate market can be highly profitable when guided by the right strategies. Dennkarm Prime Properties is committed to helping investors identify high-value opportunities, particularly in promising locations like Thigio in Kikuyu.

12. Call to Action

📢 Ready to make a smart real estate investment? Let Dennkarm Prime Properties guide you to the best opportunities in Kenya!

📞 Call/WhatsApp: 0722-45-45-18 / 0101-45-45-00

Email Us: info@dennkarmproperties.com

🌐 Website: https://dennkarmproperties.com/

13. Additional Information

For more expert insights, check out these resources:

- Capital Gains Now at 15%: What It Means for Property Sellers

- 4 Promising Up and Coming Real Estate Hotspots in Kenya

- 5 Best Ways to Finance Land in Kenya

- Ministry of Lands and Physical Planning – Visit Here

- Kenya Revenue Authority – Real Estate Taxation Guide – Read More

- Investment Guide for Foreign Investors in Kenya – Learn More